All taxes taken out of paycheck

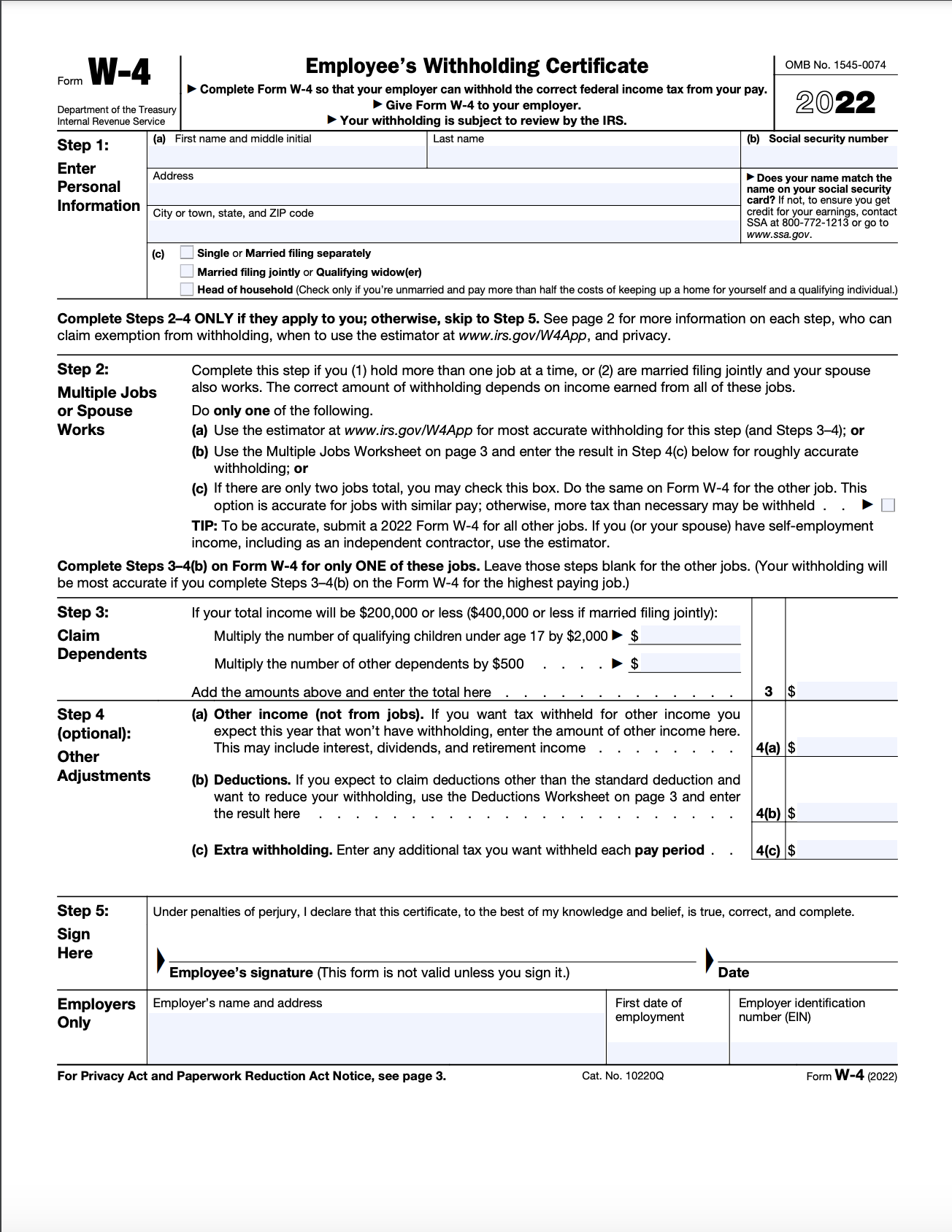

The simplest way to change the size of your paycheck is to adjust your. There are two types of payroll taxes deducted from an employees paycheck.

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. However there are certain steps you may be able to take to reduce the taxes coming out of your paychecks. Depending on your state and local.

You pay the tax on only the first 147000 of. Only the very last 1475 you. Answer 1 of 6.

Everyone should check their withholding Its important to revisit your tax withholding especially if major changes from the Tax Cuts and Jobs Act affected the size of. Youll sometimes hear this referred to as pre-tax income and it means two things. Also Know how much in taxes is taken out of my paycheck.

To declare youre exempt from federal income taxes youll write the word exempt on line 7 of your W-4 form. Also What is the percentage of federal taxes taken out of a paycheck 2021. These are contributions that you make before any taxes are withheld from your paycheck.

Youll still have Social Security Medicare and any state or local. 62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62. Social Security and Medicare.

Contributions to a traditional 401 plan come out of your paycheck before the IRS takes its cut. Federal law says your employer must take federal income tax and FICA taxes out of your paychecks unless youre excluded from withholding. For a single filer the first 9875 you earn is taxed at 10.

What is the percentage that is taken out of a paycheck. In the United States the Social Security tax rate is 62 on. Discover The Answers You Need Here.

Thats because the IRS imposes a 124 Social Security tax and a 29 Medicare tax on net. You can provide proof to your employer on why youre exempt. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or.

You can have your employer classify you as a. There are some limited ways you can do this legally. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

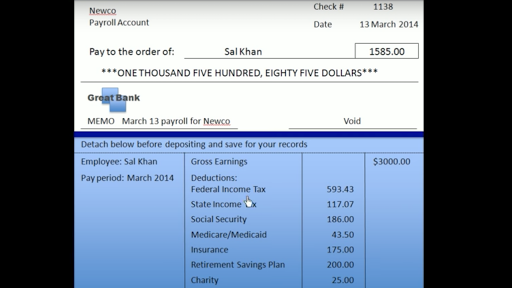

Anatomy Of A Paycheck Video Paycheck Khan Academy

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Paycheck Calculator Online For Per Pay Period Create W 4

Understanding Your Paycheck

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

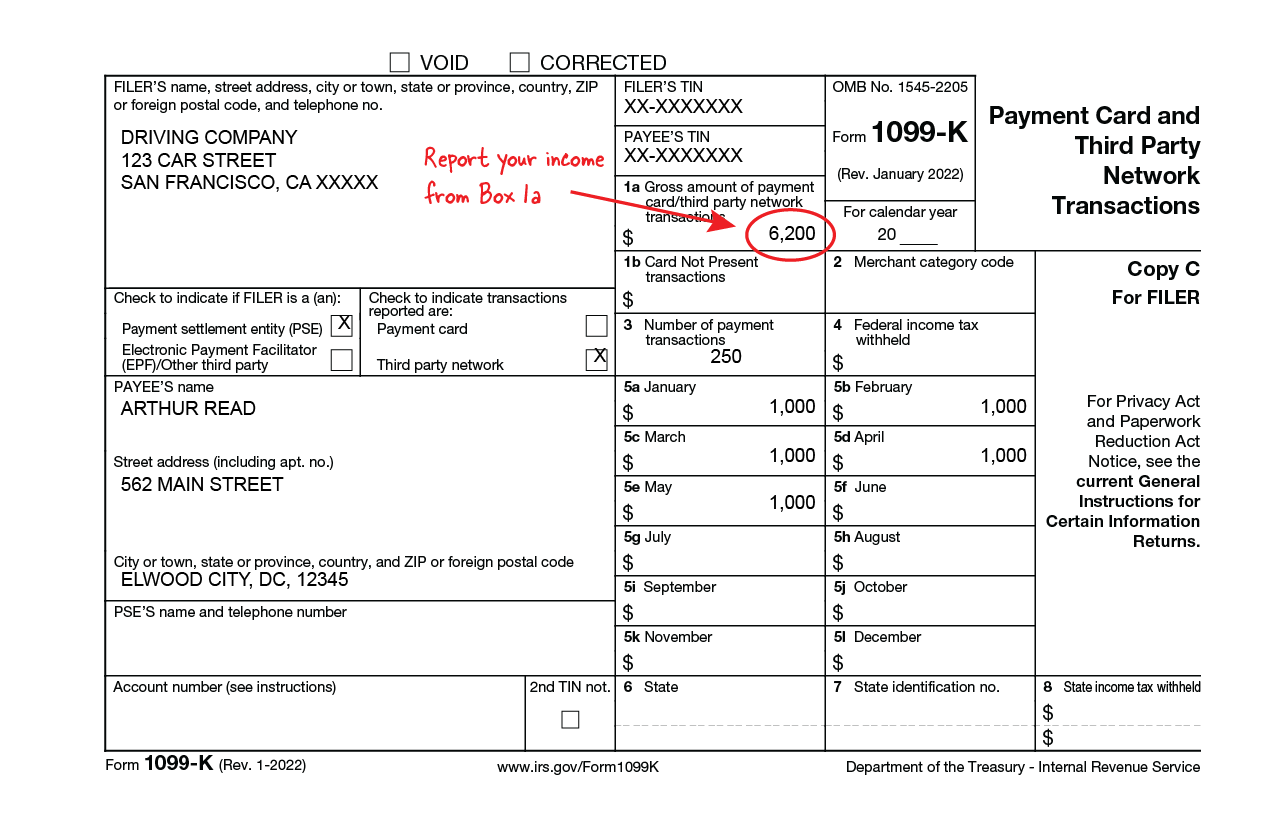

Tax Information Career Training Usa Interexchange

Paycheck Taxes Federal State Local Withholding H R Block

What Are Payroll Deductions Article

Tax Information Career Training Usa Interexchange

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Understanding Your Paycheck Credit Com

How Do Food Delivery Couriers Pay Taxes Get It Back

Check Your Paycheck News Congressman Daniel Webster

Calculation Of Federal Employment Taxes Payroll Services

What Are Employer Taxes And Employee Taxes Gusto

Different Types Of Payroll Deductions Gusto